Estimated reading time: 13 minutes

Key Takeaways

- Reliable CLV improvement comes from precise measurement, actionable segmentation, and AI-driven prediction built into every marketing motion.

- Lifecycle mapping, personalized cross-sells, high-value loyalty programs, and win-back flows are core levers to accelerate profitable growth.

- Omnichannel experience, operational data discipline, and targeted retention strategies are essential for compounding customer value.

- Pitfalls like vanity metrics, over-discounting, and static segmentation erode long-term CLV.

- Brands can see meaningful results in 6–12 weeks by prioritizing onboarding, replenishment, and smart channel orchestration.

Table of Contents

- How to improve CLV

- Segment customers with RFM and prediction

- Design lifecycle journeys that compound value

- Operationalize AI and analytics for decision speed

- Create frictionless omnichannel experiences

- Grow average order value without training deal seekers

- Double down on retention economics and service quality

- Bring it together on paid media and lifecycle channels

- A 90-day CLV acceleration plan

- How Kuma fits into your CLV strategy

- Common pitfalls to avoid

- Final thought and next step

- FAQ – Improving CLV

How to improve CLV

If you’re asking how to improve CLV, you’re laser-focused on the metric that most reliably compounds growth. Customer lifetime value is the total revenue a customer generates over their lifecycle with your brand. It dictates your acquisition budget, shapes your product roadmap, and steers your retention game. A clear definition and formula for CLV covers average order value, purchase frequency, gross margin, churn, and the impact of discounts and returns.

Reliable CLV improvement is impossible without trustworthy measurement:

- Define your formula and its components. Calculate CLV using real, cohort-based order histories, don’t rely on static or industry averages.

- Set a target CLV to CAC ratio. Most sustainable brands operate within a 3:1 to 5:1 ratio, meaning a customer brings in three to five times what it cost to acquire them.

- Analyze by cohort. Cohort analysis by first purchase month or acquisition channel highlights whether improvements are structural or just seasonal.

- Track retention and churn rate by segment and time window; these are your leading indicators of future CLV swing (Churn rate reference).

A critical data axiom: If you can’t see CLV by cohort and by segment, you can’t sustainably improve it.

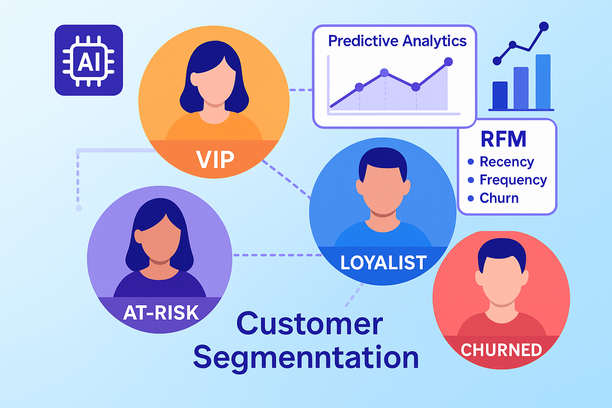

Segment customers with RFM and prediction

Profitable CLV programs begin with segmentation that is understandable by humans and actionable by algorithms. Start with RFM segmentation: group customers by Recency, Frequency, and Monetary value. This instantly reveals VIPs, loyalists, high potentials, at-risk, and nearly lost buyers (RFM segmentation).

Advance your segmentation by integrating product affinity, lifecycle intent, and dynamic status changes. Customers do not sit still, move customers into new segments as soon as fresh actions signal churn risk or conversion momentum. Layering on machine learning, predict each customer’s probability of repeat purchase, next best item, and churn risk. Approaches like logistic regression, random forest, or gradient boosting (applied to your own e-commerce and campaign data) readily outperform gut feel, if you activate the results with actual marketing creative, messaging, and offers.

Design lifecycle journeys that compound value

Every customer touchpoint is a chance to increase frequency, AOV, or relationship length. Lifecycle optimization means mapping and redesigning:

- Onboarding (first 45 days): Tailored onboarding and 3–5 post-purchase messages set the CLV trajectory. Poor onboarding is the #1 cause of one-and-done buyers. Personalize communications and trigger time-sensitive replenishment or complementary product suggestions based on their first purchase.

- Activation to second purchase: Pull forward the second order with relevant cross-sells, bundles, and behavioral triggers such as browse abandonment, interest in certain categories, or price-drop alerts.

- Mature engagement: Tiered loyalty programs, individualized recommendations, and high-value experiential rewards elevate engagement, share of wallet, and retention. According to research on personalization, brands that execute this well out-earn their peers by as much as 40%.

- Save and win-back: Use predicted churn and declining engagement signals (fewer sessions, longer repurchase gaps, fewer email clicks) to trigger value-first rescue campaigns. Remind lost customers what they loved, share updates or improvements, and give a low-friction reason to return.

Operationalize AI and analytics for decision speed

Powerful prediction is table stakes, but action is king. Key moves include:

- Refresh every customer’s churn risk, next best product, predicted CLV, and discount sensitivity score weekly.

- Sync these scores to CRM, ads, and messaging tools to dynamically adjust offers, creative, and frequency by segment.

- Use bandit or Bayesian testing to optimize discounts and minimize margin loss while maintaining strong conversion.

- Monitor dashboards showing cohort CLV, repeat purchase rates, and retention curves, tied to campaign control groups, to measure true lift, not vanity metrics.

Create frictionless omnichannel experiences

Across 46,000 shoppers, data shows that omnichannel consumers spend more and stick around longer. To boost CLV:

- Ensure pricing, product, and inventory consistency on site, marketplaces, and ads.

- Flexible fulfillment and easy returns decrease purchase anxiety and increase repeat buying, even if return rates rise slightly, CLV typically grows.

- Set channel-aware frequency caps, avoid blasting a customer on social after an email open or high-intent site action.

Grow average order value without training deal seekers

AOV is a core driver of CLV, but excessive discounting can backfire. Boost value with:

- Bundles and premium ladders. Offer nuanced bundles tied to use case and nudge top customers toward premium or limited editions.

- Contextual recommendations powered by co-purchase affinity, both in-cart and post-checkout.

- Smart pricing: Leverage anchors, shipping thresholds, and loyalty perks. Reserve discounts for surgical moments, save high incentives for at-risk or win-back groups, not mass blast campaigns.

Double down on retention economics and service quality

Retention improvements of just 5% can yield 25–95% higher profits depending on your business model. The lesson: it always pays to invest in frictionless, high-quality experiences.

- Empower support with purchase and browsing history to solve issues quickly and personally.

- Proactive outreach to groups with common concerns prevents avoidable churn and builds goodwill.

- Close the loop, solicit and act on feedback. Customers who feel heard, and who see changes implemented, become loyalists.

Bring it together on paid media and lifecycle channels

Real CLV gains come from omnichannel synchronization:

- Paid media: Activate high-CLV lookalikes, suppress low-value prospects, and map creative to each lifecycle stage.

- Email/SMS: Personalize onboarding, replenishment, and win-back flows by detailed segment, with clear tests on subject lines, creative, and laddered offers.

- Owned channels: Customize online experience for VIPs, newcomers, and at-risk users, think homepage personalization, navigation shortcuts, and bespoke landing pages.

A 90-day CLV acceleration plan

Weeks 1–2: Set your baseline

- Calculate CLV by cohort and channel. Benchmark against CAC.

- Build RFM segments: VIP, high-potential, one-and-done, and at-risk.

- Map lifecycle flows and mark your biggest drop-offs.

Weeks 3–6: High-leverage fixes

- Optimize post-purchase onboarding to trigger second purchase sooner with replenishment/cross-sell.

- Launch personalized, dynamic win-back flows for at-risk customers.

- Shift paid media toward predicted high-CLV lookalike audiences and suppress low-value.

Weeks 7–10: Raise AOV and frequency

- Roll out bundles and tailored product recommendations on PDP, cart, and in post-purchase flows.

- Launch or upgrade your loyalty program focused on top segments.

- Implement channel-aware frequency management.

Weeks 11–12: Measure, learn, and scale

- Track cohort CLV curves and CLV:CAC improvements. Use holdout/control campaigns to prove lift.

- Double down on tactics with real CLV impact. Prune the rest.

- Summarize and share a one-page roadmap for next-phase scaling.

How Kuma fits into your CLV strategy

All of this becomes exponentially easier when segmentation and activation are unified in one platform. Kuma is an AI marketing assistant and segmentation engine for Shopify merchants to boost ROAS, LTV, and retention. With Kuma:

- Build predictive and custom audiences from customer, order, and product behavior without demographic crutches.

- Sync effortlessly to Meta, Google, TikTok, Pinterest, Klaviyo, HubSpot, and more, ensuring every channel gets segment-aware creative and optimized bidding.

- Analyze cohorts and campaigns using an AI chatbot built for business users to interrogate data, produce visualizations, and uncover segment insights (this is for your marketing team, not as a customer chatbot).

- Leverage RFM and predictive segmentation to personalize lifecycle flows and automate win-backs.

For a detailed walkthrough, see how Kuma enables predictive CLV growth.

Common pitfalls to avoid

- Chasing short-term top-line growth at the expense of true CLV (AOV bumps that erode margin or spike returns hurt profitability).

- Over-discounting. This trains deal-seeking behavior and compresses margin over time. Use focused, data-driven incentives.

- Static segmentation. Customers move faster than monthly status updates, your data and messaging must, too.

- Vanity metrics. Only experiments that improve incremental profit and cohort CLV matter, not just engagement rates.

Final thought and next step

Improving CLV is the highest-leverage growth lever in modern marketing. It calls for accurate measurement, customer-centric journey design, and operational discipline, putting segmentation and prediction to work in every channel and every campaign.

The upside is exponential: modest retention gains translate to oversized profit improvements because value compounds on cohorts that already trust you (study reference).

Ready to lift your CLV and orchestrate predictive marketing on Shopify? Explore Kuma’s accelerated LTV roadmap or reach out for a tailored strategy.

FAQ – Improving CLV

What if we have limited data?

You can start simple. Even basic RFM segmentation and a straightforward CLV model using historical orders deliver immediate value. Enrich your model later with browsing data and campaign engagement signals.

Do we need advanced machine learning to win at CLV?

Not at first. Reliable prediction helps you decide, but sophisticated models aren’t always required. For most brands, a logistic or gradient boosting model for churn and next best purchase is enough. The most important step is activating those predictions so they actually steer your targeting, messaging, and spend.

How fast can we see results from CLV programs?

Many brands realize measurable improvements in CLV-to-CAC ratios within 6–12 weeks, especially after fixing onboarding, dialing in replenishment, and shifting paid media toward high-CLV audiences.

Which marketing channels are best for CLV growth?

The best mix is the actual combination your customers use most. Orchestrate seamless, consistent experiences across site, email, SMS, and paid media. Research shows that omnichannel shoppers are consistently more valuable (omnichannel data), so invest in orchestration, not single-channel bets.