Estimated reading time: ~12 minutes

Key takeaways

- Two proven paths: sell direct-to-consumer on Shopify or earn within the ecosystem (apps, themes, content, services).

- Unit economics first: price to contribution margin, watch CAC vs. LTV, and track cash flow and payback periods.

- Data-driven marketing wins: SEO, helpful content, methodical paid testing, and lifecycle email/SMS drive durable profit.

- Predictive segmentation compounds: RFM and AI-powered audiences lower CAC, raise LTV, and improve ROAS.

- Scale with discipline: follow a 30-60-90 plan, diversify channels, and automate insights-to-action across ad and email platforms.

Table of contents

- How do you make money on Shopify? Two paths

- From traffic to profit: the marketing math that matters

- Profit mechanics and cost control you cannot ignore

- Where AI and predictive segmentation unlock profit

- A realistic 30-60-90 day plan to make money on Shopify

- Common pitfalls that quietly kill profit

- Where AI consulting mindsets make a difference

- Bringing it all together

- FAQ – Everything You Need to Know About Making Money on Shopify

How do you make money on Shopify? Two paths

If you are asking how do you make money on Shopify, you are already thinking like a builder. Shopify is more than an online store tool. It is a commerce ecosystem where merchants, developers, designers, and consultants can each create sustainable income streams. In this guide, we break down the most reliable ways to earn, how to manage costs and margins, and how to use data and AI to scale profitably. We will also show where a platform like Kuma helps you get there faster by turning your first-party Shopify data into predictive audiences and higher lifetime value.

The short answer: there are two big paths, sell to consumers through a Shopify store, or earn within the Shopify ecosystem by supporting other merchants. Within those paths are proven models you can launch quickly and scale responsibly.

Direct-to-consumer models you can start now:

- Sell physical products with inventory you control. You source or manufacture, set margins, and fulfil orders yourself or via a 3PL. This gives you more control over product quality and profit margins than other models.

- Dropshipping. You sell products you do not stock. When a customer orders, a supplier ships on your behalf. It is fast to launch and capital light, though competition is high and margins are typically thinner. Learn the fundamentals here: Dropshipping

- Print on demand. You upload designs for apparel, mugs, posters, and more. Items are printed and shipped per order. This is ideal for creators, brands, and communities where design and identity drive demand.

- Digital products and services. Templates, presets, e-books, online courses, or paid communities can be sold with near-zero marginal costs once created.

- Subscriptions. Recurring delivery for replenishable goods or curation boxes creates predictability and higher lifetime value. For a broader look at subscriptions and consumer behavior, see this research

Ecosystem models that do not require you to run a store:

- App development. Build software that solves merchant pain points, such as analytics, merchandising, or post-purchase operations. This model often runs on monthly recurring revenue with attractive gross margins if you can win adoption and retention.

- Theme design. Create and sell storefront themes. Successful designers maintain portfolios targeting specific industries or aesthetics.

- Affiliate and content publishing. Recommend and educate prospective store owners. Monetize through affiliate commissions. This rewards thoughtful, trustworthy content and an audience-first strategy.

- Expert services and consulting. Help merchants set up stores, optimize conversion rates, implement analytics, and drive acquisition. Specialists in SEO, paid media, conversion rate optimization, and AI consulting often command premium rates.

No matter which path you choose, the businesses that consistently make money on Shopify share the same habits: they select defensible niches, price for margin, measure unit economics like customer acquisition cost and lifetime value, and operationalize data-driven marketing.

From traffic to profit: the marketing math that matters

Revenue follows relevance. To turn attention into sales and sales into profit, keep these fundamentals front and center.

- Start with the right keywords and structure. Organic search remains one of the most durable acquisition channels. Use the SEO starter guide to align technical basics, metadata, and structured data. Prioritize intent-rich keywords, accurate product data, clean URL structures, fast page speed, and helpful content that answers pre-purchase questions.

- Build helpful content that compounds. Buying guides, how-to articles, and comparison content bring qualified traffic long before someone is ready to buy. This compounds over time as you rank for more queries and capture more intent without paying per click.

- Do social with a plan. Choose platforms your buyers actually use, then diversify content across education, UGC, creator collaborations, and product stories to avoid looking like a feed of ads. For context on social platform usage, see this fact sheet

- Treat paid media like a portfolio. Paid search captures intent. Paid social builds demand and nurtures affinity. TikTok and short video creative can unlock cold audiences at scale. Test creatives and audiences methodically. Retire what does not meet your benchmarks and reallocate to proven winners.

- Master the CAC and LTV math. Customer acquisition cost is what it takes to get a new customer. Lifetime value is what that customer will spend over time. Your job is to lower CAC while increasing LTV so you can spend confidently. A quick primer on CAC: Customer acquisition cost and on customer lifetime value: Customer lifetime value

- Use email and SMS as profit centers. Welcome flows, browse and cart recovery, post-purchase cross-sells, replenishment reminders, and win-back campaigns are where margin lives. Segment by what people bought, how recently they engaged, and their predicted value next.

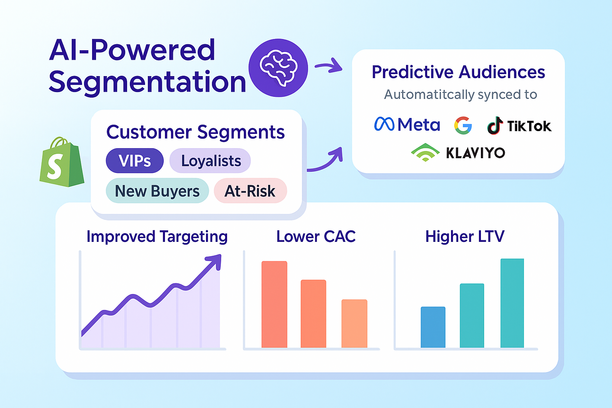

The most powerful shift you can make is to move from one-size-fits-all marketing to segment-specific offers and creative. RFM segmentation is a proven way to do it. It groups customers by Recency, Frequency, and Monetary value so you can tailor your strategy to VIPs, loyalists, new buyers, and at-risk segments. Read the model’s background here: RFM segmentation

Profit mechanics and cost control you cannot ignore

You do not make money by selling a lot. You make money by keeping a lot. That requires ruthless clarity on costs and margins.

- Price to a target margin, not to competitors. Calculate landed costs per SKU including product, packaging, freight, duties, payment processing, returns, and handling. Then layer in your target contribution margin after marketing. If your blended margin cannot handle your average CAC and still leave room for overhead, your pricing or product strategy needs work. If you need a refresher on gross margin, here is a useful explainer

- Understand payment processing fees. Typical online processing fees sit in the 2.4 percent to 2.9 percent plus a fixed fee per transaction range based on your plan and processor. These pennies add up quickly at scale, so include them in your SKU-level P&L.

- Budget for apps and tools with intent. Useful apps unlock revenue and efficiency. Redundant or underused tools quietly erode profit. Audit your stack quarterly.

- Launch budgets are elastic, but physics still apply. Lean sellers can launch with a few hundred dollars if they use a free theme, minimal apps, and organic channels. A more professional launch with custom creative, paid tests, and initial inventory typically requires a few thousand dollars. See this overview on startup costs when planning.

- Watch cash flow like a hawk. Inventory-based models often die from cash starvation, not lack of demand. Forecast reorders, lead times, seasonality, and liquidity buffers. If you sell subscriptions, model churn and renewal curves conservatively.

- Track the right leading indicators. Blended CAC by channel, payback period, 7 to 30 day cohort LTV, repeat purchase rate, and contribution margin after ads are more predictive than vanity metrics like followers or raw traffic.

Where AI and predictive segmentation unlock profit

Making money on Shopify is increasingly about who you target and what you say, not just how much you spend. That is where data, AI consulting principles, and modern segmentation change the game. If you are not using your own data to drive acquisition and retention, you are leaving ROAS and LTV on the table.

Kuma is built precisely for this. It is an AI marketing assistant and audience segmentation environment powered by your Shopify data that helps you:

- Build predictive and custom audiences using RFM, recency windows, purchase frequency, total spend, product affinities, and more.

- Sync those audiences effortlessly to Meta Ads, Google Ads, TikTok, Klaviyo, and HubSpot, plus export to Pinterest Ads. Your audiences stay fresh automatically, so campaigns always target the right people.

- Analyze campaigns and cohorts to find pockets of profitable demand and reduce wasted spend.

- Use a chatbot that reads your Shopify data to answer questions, build tailored marketing campaigns, create visuals and graphs, and help you build high-converting audiences. This chatbot is for your internal marketing and growth team, not for customer support or website chat.

Why this matters to the marketing math:

- Lower CAC with better targeting. Instead of broad, cold audiences, build lookalikes and in-platform segments based on your highest-value customers. Predictive audiences let you prospect into people who resemble your VIPs or who show early signs of becoming high LTV buyers.

- Raise LTV with precise retention. Identify at-risk segments before they churn and trigger reactivation offers or content. Build replenishment and cross-sell flows tied to products and buying cycles. Prioritize the customers who will drive the next dollar of margin, not just the next click.

- Improve ROAS with relevance. Creative and offers aligned to segment intent outperform generic ads. Targeting past purchasers of category A with a cross-sell from category B often raises average order value while reducing wasted impressions.

If you want to see how brands use these techniques in the real world, explore success stories and product details at https://kuma.marketing

A realistic 30-60-90 day plan to make money on Shopify

Day 1 to 30: lay a strong foundation

- Validate your offer. Use quick surveys, small ad tests, and competitor reviews to confirm demand and price tolerance.

- Set target unit economics. Define target contribution margin after ads and your initial CAC threshold. For example, aim for CAC under 30 percent of AOV while you validate.

- Stand up the storefront. Keep it simple and fast. Clear value proposition, trust signals, high-quality product pages, and frictionless checkout.

- Seed content and SEO. Publish a few intent-rich guides and FAQs mapped to your core keywords. Follow this technical checklist to avoid crawling and indexing problems.

- Install analytics correctly. Ensure conversions, events, server-side tracking where possible, and channel attribution are set before you spend. Define your north-star metrics.

Day 31 to 60: unlock acquisition and retention

- Launch test campaigns across two to three channels. Example portfolio: Google Search for bottom-of-funnel queries, Meta for creative-led prospecting and retargeting, email for lifecycle flows.

- Build segmentation and flows. Implement RFM-based segments and set up welcome, cart recovery, first to second purchase nudges, and replenishment sequences. Reference the framework: RFM segmentation

- Apply predictive audiences. Use Kuma to build high-propensity segments and sync automatically to Meta, Google, TikTok, and Klaviyo so your spend focuses on the right people.

- Iterate creatives weekly. Test headlines, hooks, UGC, and offers. Kill what underperforms, scale winners, and keep testing.

Day 61 to 90: scale what works and protect margin

- Shift budget toward channels and segments with the best CAC to LTV ratios. Track payback periods and expand only when unit economics support it.

- Add AOV levers. Offer bundles, cross-sells, and threshold-based free shipping. Tailor these by segment, not one-size-fits-all.

- Launch a subscription or membership if your product fits. Start small with replenishment or perks for loyalists. For behavioral context on why subscriptions work, read this research

- Tighten operations. Audit app costs, renegotiate fulfillment rates, and refine packaging to reduce dimensional weight fees without harming unboxing.

- Institutionalize insights. Use Kuma’s chatbot to ask ad hoc questions of your Shopify data, generate weekly performance summaries, and visualize cohort trends so your team stays aligned on signal, not noise.

Common pitfalls that quietly kill profit

- Weak niche economics. If your category is hyper-commoditized, your margin might not support paid acquisition. Look for defensibility via brand, positioning, or product innovation.

- Pricing to match competitors instead of your costs. If you do not price to a target contribution margin after ads, you can sell a lot and still lose money.

- Channel dependency. If 90 percent of your revenue is from one ad platform, any policy or auction change can crater performance. Diversify gradually.

- Neglecting retention. New-customer revenue feels exciting. Profit typically comes from second and third orders. Set goals for repeat purchase rates and 60 to 90 day cohort LTV.

- Data without action. Pulling reports is not a strategy. Use segmentation to change who you target, what you offer, and how you message.

Where AI consulting mindsets make a difference

- Treat data as a product. Decide which customer signals matter most and design your collection and modeling around them.

- Build predictive use cases, not dashboards. The question is not what happened last week. It is who will buy next week, what they will buy, and how to reach them at the lowest cost.

- Automate the last mile. Insights do not pay the bills until they change audiences, bids, and messages in your ad and email platforms. Kuma’s one-click syncing to Meta, Google, TikTok, Klaviyo, HubSpot, and exports to Pinterest Ads closes that gap.

- Keep a human in the loop. AI is a multiplier of good strategy. Use it to scale your best hypotheses, not to replace them.

Bringing it all together

So, how do you make money on Shopify in 2025? You choose a model with healthy margins, build a store that loads fast and explains your value clearly, and create a marketing engine that compounds. You fix unit economics early and treat CAC and LTV as controllable variables. You segment customers with RFM and predictive signals so your best spend goes to your best buyers. You automate syncing to your ad and email platforms so your targeting is always fresh. And you scale like an operator, not a gambler.

If you want a faster path to that reality, explore how Kuma turns your Shopify data into predictive audiences, better ROAS, and higher LTV while saving your team time. See how it works and what other brands have achieved at https://kuma.marketing

Ready to turn your data into revenue? Contact us to see a tailored demo, or start by syncing your store and building your first predictive audiences.

FAQ – Everything You Need to Know About Making Money on Shopify

What are the fastest ways to start earning on Shopify?

The quickest paths are dropshipping, print on demand, and digital products/services. These models minimize upfront inventory risk so you can validate demand, iterate offers, and improve unit economics before scaling.

How should I think about CAC and LTV when I’m just starting?

Set an initial CAC threshold (for example, under 30% of AOV) while validating. Track early cohort LTV (7–30 days) and aim to improve it with welcome, cross-sell, and replenishment flows. Over time, your goal is to reduce CAC and increase LTV so you can spend confidently.

Which marketing channels are most reliable for profitable growth?

Organic search compounds when you follow the SEO starter guide and create helpful content. Paid search captures intent; paid social builds demand. Email and SMS are profit centers via lifecycle flows such as welcome, cart recovery, and win-backs.

How do I price products to protect margins?

Price to a target contribution margin after ads. Include all landed costs (product, packaging, freight, duties, payment processing, returns, handling). Validate that your blended margin can absorb your average CAC with room for overhead. For a refresher, see this explainer.

What segmentation should I use for better targeting?

Start with RFM segmentation, grouping customers by Recency, Frequency, and Monetary value, to identify VIPs, loyalists, new buyers, and at-risk segments. Learn more here: RFM segmentation.

How does Kuma help lower CAC and raise LTV?

Kuma builds predictive and custom audiences from your Shopify data and syncs them to ad and email platforms automatically. This improves targeting, reduces wasted spend, and powers precise retention flows, lowering CAC, lifting LTV, and improving ROAS. Explore details at https://kuma.marketing.